Rent-to-Own Solar vs. Buying Outright: Pros & Cons

For many homeowners going solar and paying less for power is a “No Brainer”. — but how you choose to fund your solar project can make all the difference. Two of the most popular funding options are either

buying a solar system outright (traditional financing)

or choosing a rent-to-own (solar lease/TPO) model.

Both have their advantages, but the best choice for your family would mainly depend on your financial goals, your ability to qualify for funding, current FED interest rates, and if you pay enough in taxes to receive the full 30% discount on your solar project.

Sunrun introduced the first mainstream residential solar‑lease/PPA offering in 2007, marking the birth of third‑party ownership (TPO) for U.S homeowners.

Since the birth of this new TPO program, the share of homeowners that chose to lease their solar systems quickly grew from a niche option to a dominant financing model.

-

Leases/TPOs Dominate. Big investors grab the tax breaks and borrow at only 4-5%, so they offered Solar Rate Plans that were instantly cheaper than the utility—with no loan on your credit report.

-

Direct Ownership makes a comeback. New 25-year solar-loan companies came in with $0 down programs that matched the TPO lower monthly payments. Since you now owned the system and kept the tax credit, buying became the better value for many families.

-

Interest-rate hikes pushed solar-loan APRs up to 7-10%, but lease providers’ costs stayed low and they gained extra IRA bonus credits. That swung the pendulum back— now in 2024 about half of new systems are leases again today.

Homeowners loved the idea of going solar with $0 down, instant bill savings, and zero maintenance worries, TPO felt like swapping one utility bill for a cheaper, hassle-free version—no big loan or tax paperwork required.

Another major reason as to why the “Rent to Own” model worked so well was because solar leasing companies pool thousands of solar systems together with big investors who have plenty of tax liability. Those investors can monetize the full 30% tax credit plus bonus depreciation up-front—about 45% of the system cost—something most homeowners can’t do. This overall lower net costs for the investors allows the leasing company to easily provide homeowners a solar rate plan that starts 10-20% below their current utility bill without having to make any investment of their own.

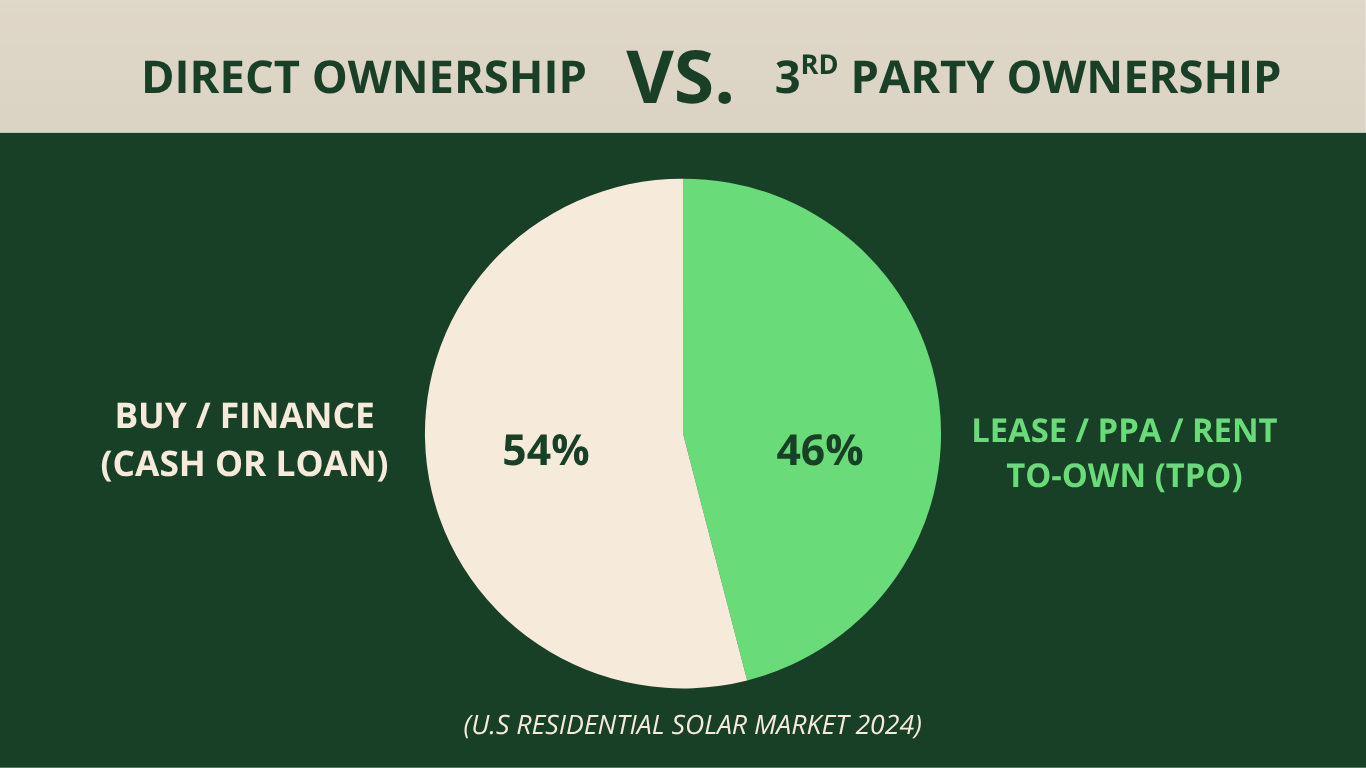

This Pie-Chart Illustrates the 2024 U.S. residential‑solar market split by financing model. Homeowner‑owned systems (cash or loan) held 54 % of new installs, while third‑party ownership (leases, PPAs, rent‑to‑own) captured 46 % .

Bottom line—third‑party ownership has become more popular again after years of decline, driven mainly by high interest‑rates and IRA bonus credits that favor project‑level tax equity.

Loans/ Direct Ownership: still win on lifetime ROI when rates drop below ~5 %.

Leases/TPO/PPA: can be compelling today for cash‑constrained customers, especially if the product includes battery storage and keeps annual escalators below retail‑rate inflation.

Let’s break down some of the key differences of each so that you can make the right choice for your family and future.

🔁 Rent-to-Own Solar (Solar Leasing)

With a rent-to-own solar plan, you don’t pay for the system up front nor take out a loan. Instead, you sign up for a monthly payment plan similar to how your current utility operates. You get all the benefits of solar energy, while the solar company installs, owns, and maintains the system on your behalf.

✅ Pros

No Upfront Cost: $0 down makes it accessible to more homeowners.

Instant Savings: Monthly payments are usually lower than your current electric bill.

Maintenance Included: The provider handles servicing, monitoring, and repairs.

Option to Buy: Most leases let you purchase the system anytime after year 5.

Transferable: If you sell your home, the lease can be transferred to the new owner.

⚠️ Cons

You Don’t Own It Right Away: Until you buy it out, the solar company keeps the tax credits and system ownership.

No Equity: You don’t have ownership in the system unless you eventually choose to purchase it.

💰 Buying Outright

Buying a solar system means you pay the full cost upfront or finance it with a loan. You own the equipment immediately and receive all financial incentives — including federal tax credits and rebates.

✅ Pros

Full Ownership: You own the system from day one and can benefit from all incentives.

Max Savings Over Time: Once your system is paid off, the energy it produces is virtually free.

Increased Home Value: Owned systems often boost resale value more than leased ones.

No Monthly Payments: Aside from occasional maintenance, your costs are minimal.

⚠️ Cons

High Upfront Cost: Buying a system can cost $15,000–$30,000 or more depending on size.

You Handle Maintenance: You’ll need to manage or pay for any repairs if there is no warranty included through your installer

🧐 So, Which Option Is Best?

Quick self-check questions

Can I monetize the full ITC in the next ~2 years?

• Yes → loan/purchase gains a 30% head start.

• No → let financier capture it via TPO pricing.Is a flat, predictable payment more appealing than a bill that rises 2-3 %/yr?

• Yes → fixed-rate loan.

• I just need a lower monthly payment today → PPA.Do I want the highest total ROI or the least responsibility?

• ROI → own/loan.

• Hands-off → lease/PPA.

If you’d like a personalized cash-flow model with your utility rate, roof size, and a funding options, just book a call and I’ll crunch the numbers.

Go with Rent-to-Own if you want low upfront costs, immediate savings, and minimal responsibility.

Buy Outright if you have the funds (or financing), have a sizable tax liability, and prefer full control ownership day 1

Either way, going solar is a step toward energy independence, lower utility bills, and a cleaner planet.

Ready to see if you qualify?

Reach out today for a free solar consultation and take the first step toward owning your power — one sunbeam at a time.